Everything You Need To Know About Credit Scores

The Ultimate Guide to Co-Signing Loans and Credit Scores: What You Need to Know

Co-signing loans can be a significant financial decision, especially when it comes to credit scores. When you co-sign a loan, you agree to take legal responsibility for someone else’s debt, which can impact your score. Understanding the pros and cons of co-signing loans is crucial for individuals seeking to improve their credit score and navigate…

Mastering Credit Improvement: 10 Expert Strategies for Success

Mastering credit improvement is a crucial step for many Americans looking to enhance their financial health. With ten expert strategies, from regularly checking credit scores to managing credit responsibly, this comprehensive guide will delve into strategies that can help individuals navigate the complexities of credit improvement successfully! Are you ready to Boost Your Score? Check,…

Boost Your Credit Score with Credit Booster Loans: A Comprehensive Guide

Understanding the significance of credit scores and their impact on financial opportunities is crucial for individuals seeking loans for various purposes. Credit Builder Loans offer a unique solution for those looking to establish or rebuild their credit history. By making consistent, timely payments on these loans, individuals can demonstrate their creditworthiness and improve their credit…

Why A Timely Payment History Matters: Secrets to a Stellar Credit Score

In today’s financial landscape, maintaining a good credit score is essential for accessing better interest rates, securing loans, and even landing a dream job. One crucial factor that impacts your credit score is your payment history. On time payments play a significant role in demonstrating your creditworthiness and responsibility as a borrower. Consistently paying your…

Stuck on Financial Resolution? 3 Financial New Year Goals 2024

January is a time for goal-setting, and in personal finance, the ultimate financial goal is achieving fiscal freedom. Set the tone for a successful financial 2024 year by maintaining a budget, tracking progress, and sticking to your financial resolutions. Three key financial goals to consider are raising your credit score, establishing and building an emergency…

Holiday Shopping Tips and Best Practices

It’s that time of year again! The 2023 holiday season is upon us, which means gathering with friends and family, special community events, holiday traditions, and lots of shopping. Ultimately, the holiday season can be a time of happiness, joy, or heightened stress. Overall, it is up to you to determine which one it will…

How to Improve Your Credit Score with Student Loan Debt

To achieve financial success, having a good credit score is essential. This can be hard to achieve when you’re in the middle of paying back your student loans. With payments set to resume for the rest of America in October of 2023, it is of the utmost importance to understand how your Student Loan Payment…

5 Ways to Build Your Credit Score from Scratch

Ready to secure your financial future? Discover five tried-and-true methods to build excellent credit even with minimal credit history as a young adult. Boost Your Score has gathered insights from credible financial organizations to help you pave the way to financial success. To get your credit score into tip-top shape, we’ll discuss five methods to do so.…

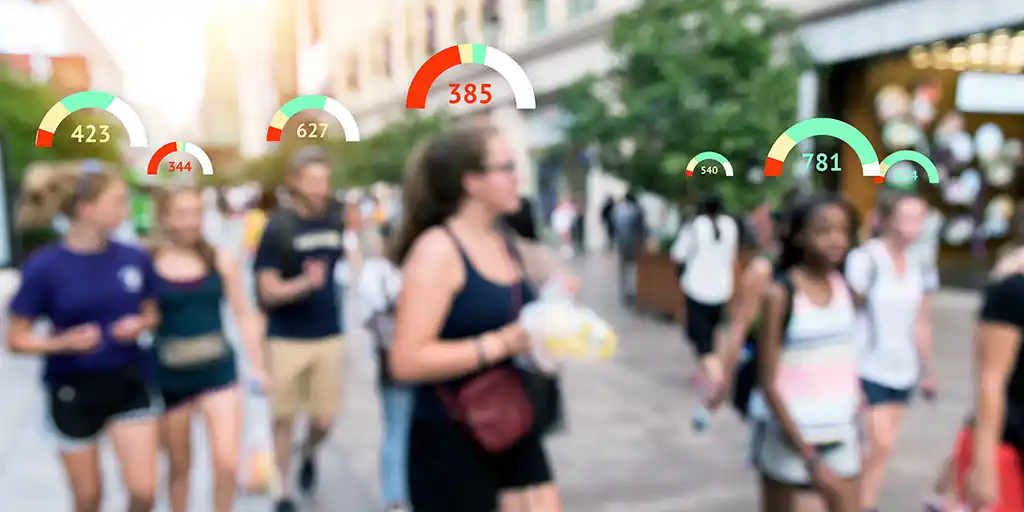

Understanding The 5 Key Factors That Affect Your Credit Score

Financial health encompasses a person’s financial decisions, including purchases, debt, investments, and assets, with credit score being just one aspect. Understanding your credit score/ credit report is crucial for achieving financial health. To optimize your credit score, focus on five key factors: Credit Score Factors That Affect Your Credit Payment History – consistent debt repayment.…

What Is a Secured Credit Card and How Can It Help Me Build Credit?

Establishing and building your credit can be tricky, especially if you don’t have a lengthy credit history or if you have a bad credit score. If you’ve never had a credit card, traditional credit card companies might deny your application due to your status as a borrower with no proven history of on-time payments. Fortunately,…