5 Ways to Build Your Credit Score from Scratch

Ready to secure your financial future? Discover five tried-and-true methods to build excellent credit even with minimal credit history as a young adult. Boost Your Score has gathered insights from credible financial organizations to help you pave the way to financial success. To get your credit score into tip-top shape, we’ll discuss five methods to do so.

- Understand the basics of a credit score

- Know which credit card you can open

- Become an Authorized User

- Pay Bills on Time

- Keep credit utilization low

Understand the basics to build your credit score from scratch.

To create or build your score, you need to understand what it is first, and why it’s so important to your overall financial health.

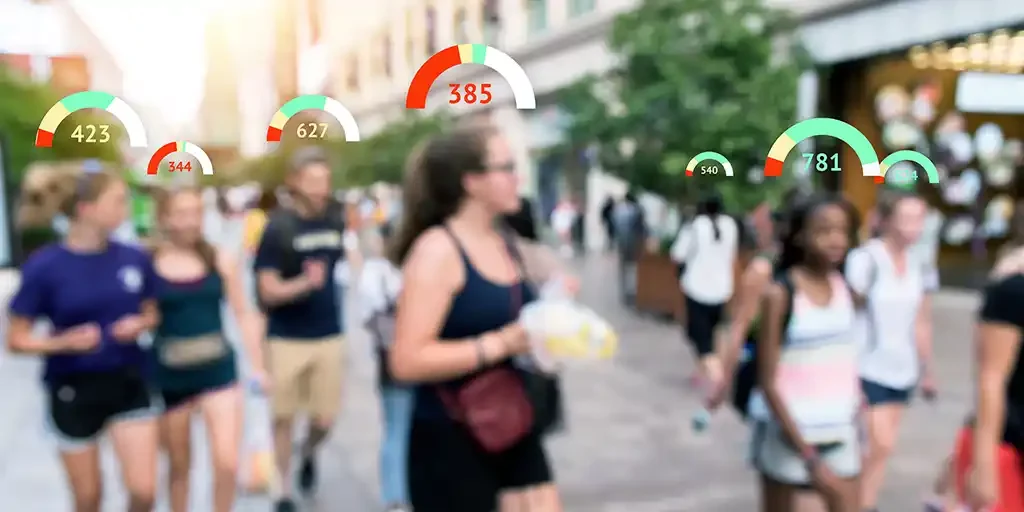

A credit score is defined as a mathematical credit scoring “model” that creates a “…prediction of your credit behavior, such as how likely you are to pay back a loan on time, based on information from your credit reports.”(What Is a Credit Score?, 2023) Good credit scores are significant to the financial well-being of an individual for numerous reasons.

The main purpose of a credit score is for businesses to gauge how “risky” you are when providing you with some sort of loan. Risk factors typically come into play when you purchase a car, rent or buy a home, or open a credit card which are linked to bad credit.

The state of your credit report can determine what interest rates you may receive when opening a line of credit. The higher the credit score, the lower the interest rate is, and vice versa. Even day-to-day expenses, like insurance and utilities in your home, require a credit check.

Know which secured credit card account you can open

A realistic option to help build your credit history in a healthy way from a young age is by opening a starter credit card, or a secured credit account. Make no mistake, these can be two distinct types of credit cards, but they have proven to achieve similar results.

Starter credit cards are a type of card that behaves like a typical credit card. One thing that makes it different is that most starter credit cards have minimal requirements to approve an individual for a new credit. This is done so that people with little to no credit history (typically younger people) can gain access to their credit scoring system. Ultimately, it will allow you to obtain a credit score upon opening.

To help build your score after establishment, it is important to spend money responsibly and pay the minimum (at least) on your card each month (Ben Luthi, 2023). On the other hand, a credit account is a financial tool designed to help individuals with limited or poor credit histories build or rebuild their credit scores. Unlike traditional unsecured credit cards, a secured card requires the cardholder to provide a security deposit upfront. This typically serves as their credit limit.

This deposit acts as collateral and minimizes the risk for the card issuer, making secured cards more accessible to those with damaged credit or a minimal history. The key to how a credit card helps raise your credit score lies in responsible usage. When you use a secured card and make on-time payments, the card issuer reports this positive payment activity.

Over time, consistent payments and maintaining a low credit utilization ratio demonstrate responsible credit management. In turn, the credit card contributes positively to your history and increases your credit score gradually.

Become an Authorized User

A third way to build credit from scratch is by becoming an authorized user on another individual’s credit card. An authorized credit card allows someone, typically a family member or friend, to use another person’s credit card with permission. The primary cardholder grants this authorization to secondary users, known as authorized users.

While authorized users can make purchases and transactions using the card, they aren’t legally responsible for the card’s balance, nor do they have control over the account. The primary cardholder remains responsible for all charges and payments. This arrangement can be beneficial for building credit, as the authorized user’s credit history may be positively impacted by the card’s payment history.

However, it’s essential to establish clear guidelines and trust when authorizing others to use your credit card to prevent potential issues. Being an authorized user of a parent’s credit card is a typical method that young people can use to build credit history.

Make on-time payments

Our fourth strategy for starting your credit file off right is by paying all bills on time. Maintaining a good payment history and consistently paying bills on time are pivotal steps in establishing and nurturing a positive credit profile. This practice holds immense significance due to its far-reaching effects on your financial well-being.

Firstly, your payment history is the most influential factor contributing to building your score, which lenders and creditors rely upon to evaluate your creditworthiness. A strong payment history can lead to a higher credit score, granting you better access to credit, increased chances of loan approvals, and more favorable interest rates.

Furthermore, responsible financial behavior reflects your financial stability and reliability, enhancing your reputation as a borrower or tenant in the eyes of lenders and landlords.

Keep lower credit utilization rate

Keeping utilization low is a fundamental practice for establishing and maintaining good credit. It is the ratio of your outstanding credit card balances to your total credit mix, and it plays a critical role in your credit score. Here’s why it’s so crucial:

Firstly, lenders and credit scoring models view low utilization as a sign of responsible credit management. When you use only a small portion of your available credit, it demonstrates that you’re not relying heavily on borrowed funds, which can indicate financial stability.

Secondly, maintaining low utilization can positively impact your credit score. FICO, one of the most widely used credit scoring models, considers credit utilization as a significant factor. The lower your utilization rate, the better it is for your credit score.

Moreover, consistently low utilization can lead to improved access to credit. Lenders are more likely to extend credit and offer favorable terms to individuals who demonstrate prudent credit usage, which often includes keeping balances well below their credit limit.

Building a positive credit history

To build your score as a young person, it’s important to take all of the above steps into consideration to have a positive impact on your score. In addition, it’s also key to check your credit score periodically. This way, you are also aware of any changes and can monitor your accounts for fraudulent purchases.

The first crucial step to building your score is understanding the importance of your credit score. Other important methods that are tried and true include opening a secure or starter credit card, becoming an authorizeimd user on a credit card, paying your bills on time, and keeping credit utilization to a minimum.

By putting these valuable insights into practice, you could be well on your way to boosting your score!

Credit Score Frequently Asked Questions

Q: What is a credit score?

A: A three-digit number that represents your creditworthiness. It helps lenders determine how likely you are to repay your debts.

Q: How can I improve my credit score?

A: There are several ways to build your score from scratch:

- Pay your bills on time.

- Keep your card balances low.

- Avoid opening too many new credit accounts.

- Pay off debt instead of moving it around.

- Regularly check and review your credit report to identify and fix any errors.

Q: Does checking my credit score lower it?

A: No, checking does not affect your credit score. This is known as a soft inquiry and does not have a negative impact on your credit.

Q: How long does it take to improve a credit score?

A: The time it takes to improve a credit score can vary depending on individual circumstances. However, with consistent positive credit behavior, you can start seeing improvements within a few months.

Q: Can I improve my credit score fast?

A: While improving takes time, there are some strategies that can help you see faster results. These include paying off high-interest debts, reducing credit card balances, and disputing any errors on your credit report.

Q: What is a good score?

A: It is typically considered to be above 700. However, the exact range may vary depending on the scoring model used by lenders.

Q: How does credit utilization affect my credit score?

A: Credit utilization refers to the amount of credit you are using compared to your total credit limit. It is an important factor in determining your credit score. Keeping your credit utilization below 30% can help improve credit.

Q: Will closing a credit card hurt my credit score?

A: It can potentially lower your credit score, especially if it has a high credit limit or if it is one of your oldest accounts. It may negatively impact your credit utilization and the length of your credit history.

Q: How long do negative items remain on my credit report?

A: Most negative items, such as late payments and collections, can remain on your credit report for up to 7 years. Bankruptcies can remain for up to 10 years.

Q: Are there any free credit repair services?

A: There are free credit repair resources available, such as credit counseling agencies and educational materials provided by government agencies. However, be cautious of companies claiming to provide “free” credit repair services as they may have hidden fees or questionable practices.

Need some more help? Boost Your Score is here for you! Be sure to check out boostyourscore.com for more information.

Works Cited

Ben Luthi. (2023, January 11). How Can a Starter Credit Card Help Build Credit?

https://www.experian.com/blogs/ask-experian/what-is-a-starter-credit-card-and-how-can-it-help-build-credit/

What is a credit score? (2023, August 28). Consumer Financial Protection Bureau.

https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-score-en-315

Disclaimer: Boost Your Score does not offer financial advice. The information presented on this page is intended for general consumer awareness and does not constitute legal, financial, or regulatory counsel. This content does not represent the perspectives of any issuing banks. While the information might include third-party references or content, Boost Your Score does not validate or guarantee the third-party information's precision. Internal links are promotional content for Boost Your Score products. Please take into account the publication date of Boost Your Score's original content and any related content to fully grasp their contexts.